Financial analysis

Section 1

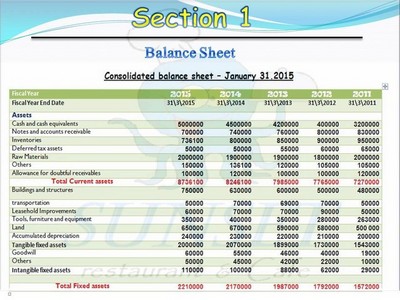

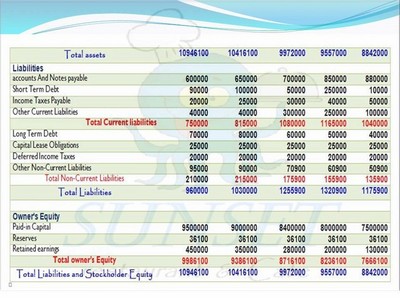

Balance sheet

A balance sheet is a picture of a company’s financial position as of a point in time. A balance sheet can be prepared as of any date, but it’s usually prepared as of month, quarter or year-end

A balance sheet is a very valuable statement that provides information about financial health of a company. Things like cash, accounts receivable, accounts payable, net worth, etc. can be determined by looking at a balance sheet.

The Balance Sheet allows operators to forecast short and long-term cash flow. As important as it is to review the Balance Sheet, few restaurants ever bother to prepare it. By checking the accuracy of the Balance Sheet, an operator can ensure the accuracy of the Income Statement. The Balance Sheet lists all the assets, liabilities and equity of the restaurant

.

Section 2

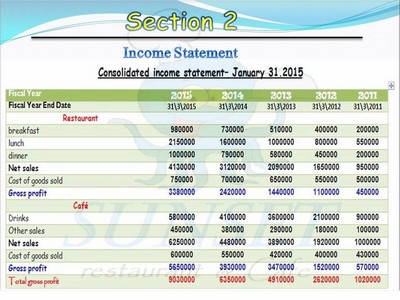

Income statement

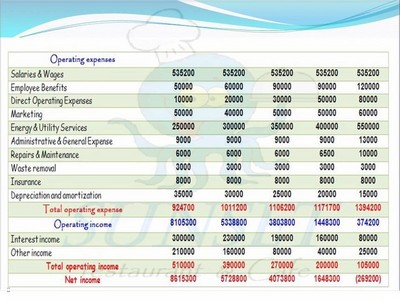

The income statement is one of the major financial statements used by accountants and business owners.

The income statement is sometimes referred to as the profit and loss statement, statement of operations, or statement of income.

The Income Statement shows how the restaurant performs over a period of time (i.e. a week, month or year). It takes all restaurant expenses into account, from prepaid expenses to expenses paid in the future. Overall, the Income Statement tells the operator if the business is making a profit. From there, the operator can begin making changes in policy and implementing strategies that will help the restaurant achieve its goals. Should new sales programs be implemented? Is food cost in line with menu prices? Is the restaurant hitting its budgets? Can the owner(s) make distributions to the partners? These are some of the key questions that need to be addressed

.

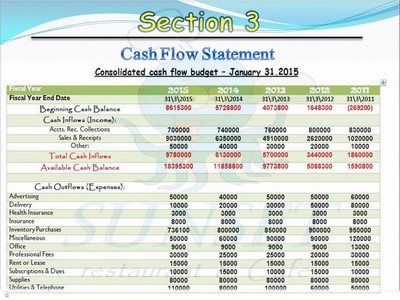

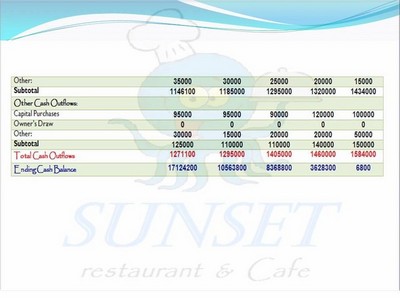

Section 3

Cash Flow Statement

Cash flow statement may provide considerable information about what is really happening in a business beyond that contained in either the income statement or the balance sheet. Analyzing this statement should not present an intimidating task; instead it will quickly become obvious that the benefits of understanding the sources and uses of a company’s cash far outweigh the costs of undertaking some very straightforward analyses.

A common problem for many restaurants is poor cash flow. Credit card and credit lines with suppliers can only carry a restaurant so far. At the end of the day, restaurants still need enough cash in the bank to cover their overhead expenses. If your restaurant is experiencing a cash flow problem, so you should make the cash flow budget to solve this problem.

ساحة النقاش